Three Items Dominate Work Session

The Jefferson County Commission held their Work Session on November 9, 2015 in the Historic Jefferson County Courthouse. Several items of interest were brought before the full body, with the issues of the potential of fiber optic Broad Ban Internet, a senior tax freeze and the scope of duties for the Quality Control Advisor being the three that were the most time intensive.

Several citizens addressed the Commission regarding the need for fiber optic broad ban internet and the request that they support a resolution that would plead the case for local governments to be able to determine the needs of their citizenship and determine how to address those needs. Commissioner McGraw will bring a resolution to the floor that will request that the Tennessee General Assembly lift the current restrictions that are stumbling blocks to providing fiber optic broad ban internet service for its citizenship. Mitch Cain, of Appalachian Electric Cooperative, informed the Commission that AEC is interested in being a carrier for fiber optic broad ban internet service and that through AEC it would be available to outlying areas that currently are not served. The City of Morristown has the capabilities of providing the service but are limited in their service area due to current legislation. McGraw’s resolution would be a first official step in Jefferson County toward the goal of fiber optic broad ban internet availability across County and would begin to answer concerns of a very active citizen’s group that has been researching and lobbying for the service.

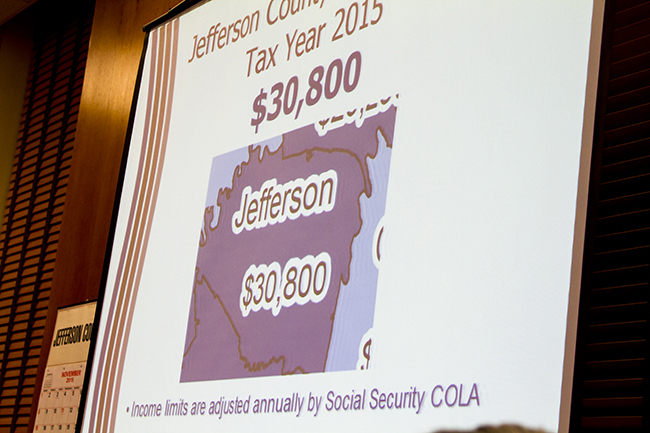

Another time intensive issue brought before the Commission was that of initiating a senior tax freeze in Jefferson County. Trustee Ginger Franklin brought a representative from State Comptroller’s Office for a presentation on a senior tax freeze. Commissioner Tucker, who asked for the item to be place on the agenda for discussion, also gave a brief presentation on numbers particular to Jefferson County. Tucker stated that, through research on the actual numbers of citizens that will meet the guidelines of a senior tax freeze ( age and income level) the impact to Jefferson County will be between $8,000 and $9,000 per year. Tax assistance for the elderly low income is already in place in Jefferson County and helps those in that demographic by picking up a portion of the tax on their primary residence. The proposed tax freeze would be an additional benefit that freeze taxes for qualifying seniors at their current level for their primary residence. Questions arose regarding the cost to administrate the freeze. However, Commissioner Tucker contended that largely the same individuals that are receiving assistance will be those eligible for the freeze, which should lessen the difficulty of gathering information. The Senior Tax Freeze will be on the voting agenda.

Though several items of other business came before the Commission, including questions to the Chamber of Commerce regarding their Business/Development Plan, information from the Facilities Committee Chairman Turner regarding situations with County owned buildings and a cost/comparison of repairing the buildings vs building on to the Justice Center and several budget amendments that will be presented at the voting meeting, one other item absorbed a fair amount of meeting time. A report that was created by Quality Control Adviors for Building 8, Mike Dockery, listed a concern with the use of prisoners for work at Jefferson County High School. Commissioner Gaut stated that he considered Dockery’s inclusion of concerns regarding the use of prisoners to be outside the scope of his duties. Commissioner McGraw stated his concern that the prisoners were not outfitted in proper gear to be on site and both Dockery and McGraw cited liability concerns. Jefferson County Sheriff McCoig said that he provided the workhouse labor at the request of the Department of Education and that the prisoners are property supervised and vetted through his department.

Other items that will be included for vote at Monday’s meeting include the restructuring of the Beer Board and a resolution regarding the State of Tennessee Deferred Compensation Plan II-401k and Participating Other Businesses.